Funeral planning, especially considering insurance for funeral costs, offers peace of mind and ensures end-of-life wishes are respected. For low-income families, tailored funeral insurance policies alleviate financial burdens during an emotional time, covering expenses like caskets, cremations, burial plots, and memorial services. Funeral assistance programs from non-profit organizations and government initiatives provide grants or subsidies, easing the financial strain for grieving families. When selecting a provider, transparency in pricing and support with claims is crucial. Planning ahead through funeral insurance ensures loved ones are shielded from financial stress during difficult times, allowing for a dignified send-off.

Planning ahead for end-of-life expenses can bring much-needed peace of mind. In this guide, we explore trusted providers and essential aspects of funeral planning. Understanding the significance of funeral planning and its financial implications is crucial. We delve into how insurance, specifically designed to cover funeral costs (funeral insurance costs), can alleviate financial stress during an already challenging time. Additionally, we highlight programs offering funeral assistance for low-income families (funeral assistance for low-income families). This comprehensive approach ensures individuals and families have access to resources and support when it matters most.

- Understanding Funeral Planning and Its Importance

- The Role of Insurance in Mitigating Financial Stress During Grief

- Exploring Funeral Insurance Options: Costs and Coverage

- Supporting Low-Income Families: Funeral Assistance Programs

- Key Considerations When Choosing a Funeral Provider

- Peace of Mind: Long-Term Planning for End-of-Life Expenses

Understanding Funeral Planning and Its Importance

Funeral planning is an essential aspect of ensuring peace of mind and making informed decisions about one’s final wishes. It involves more than just choosing a funeral service; it includes financial considerations, advance arrangements, and understanding your options for coverage. Many individuals often overlook this crucial process, but having a plan in place can offer significant advantages.

By securing insurance for funeral costs, especially for low-income families, you can alleviate the financial burden associated with end-of-life expenses. This step ensures that your loved ones are not left with overwhelming debt during an already emotionally challenging time. Funeral assistance programs and insurance options cater to diverse needs, providing a safety net for unexpected events. Understanding these choices empowers individuals to make informed decisions, ensuring their preferences are respected while guaranteeing their families’ financial security.

The Role of Insurance in Mitigating Financial Stress During Grief

When facing the loss of a loved one, grief can be overwhelming. The financial burden of funeral costs can add to this stress, especially for low-income families. This is where insurance steps in as a vital tool for peace of mind. Funeral insurance provides a safety net, ensuring that the financial strain does not weigh heavily on an already difficult time. It offers assistance with funeral expenses, allowing individuals and families to focus on honoring their loved one’s memory without the added worry of costs.

This type of insurance is tailored to cover various funeral-related expenditures, including caskets, cremations, burial plots, and even memorial services. By having this coverage in place, policyholders can access funds quickly during a time of crisis, making end-of-life arrangements with dignity and respect. It offers a sense of security, knowing that financial assistance is readily available when needed most.

Exploring Funeral Insurance Options: Costs and Coverage

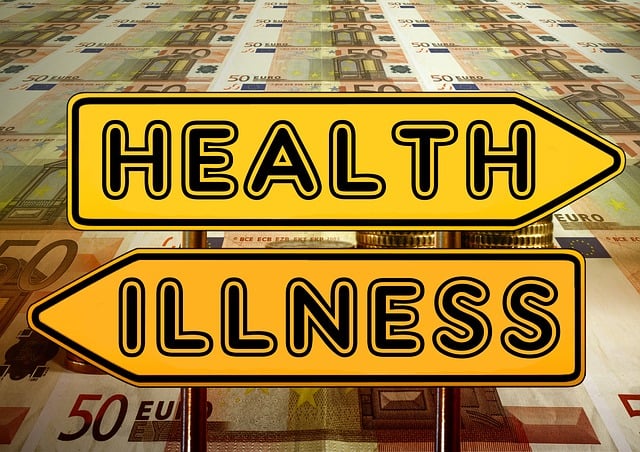

When considering funeral insurance options, understanding the costs and coverage is essential for peace of mind. This type of insurance is designed to provide financial assistance during an emotional time, ensuring your family isn’t burdened with unexpected expenses related to end-of-life arrangements. The cost of funeral insurance varies based on age, health, and the level of coverage desired.

Funeral insurance plans offer a range of coverage options, including payment for burial or cremation services, mortuary fees, and even final expenses like outstanding medical bills. For low-income families, this assistance can be invaluable, easing the financial strain that often accompanies grief. When exploring these options, it’s crucial to review the policy details, ensuring the plan aligns with your family’s needs and budget.

Supporting Low-Income Families: Funeral Assistance Programs

For many families, planning for the future includes ensuring their loved ones are taken care of financially, even in their absence. This is especially important for low-income families who may face additional challenges when it comes to funeral expenses. Funerals can be costly, with prices varying widely depending on cultural practices and local market rates. To support these families, various funeral assistance programs have been established, offering a safety net during an otherwise difficult time.

These programs are designed to help cover the costs of funeral insurance, making it more accessible for those with limited financial resources. Many non-profit organizations and government initiatives provide grants or subsidies for burial expenses, ensuring that financial constraints don’t prevent families from giving their loved ones a dignified send-off. By taking advantage of these assistance programs, low-income families can focus on mourning and celebrating the life of their departed, rather than worrying about the financial burden of funeral arrangements.

Key Considerations When Choosing a Funeral Provider

When choosing a funeral provider, several key considerations come into play to ensure peace of mind and a smooth planning process. Firstly, evaluating their financial transparency is vital. Reputable providers should offer clear pricing structures and details about what’s covered in their plans, including insurance for funeral costs. This helps families understand potential out-of-pocket expenses and prevents any surprises during an emotional time.

Additionally, it’s crucial to assess their assistance with funeral insurance costs, especially for low-income families. Some providers offer flexible payment options or work with insurance companies to ease the financial burden. This support can make a significant difference in allowing families to focus on honoring their loved ones rather than worrying about expenses.

Peace of Mind: Long-Term Planning for End-of-Life Expenses

Planning ahead for life’s inevitable transitions can be a difficult yet profoundly comforting process. Peace of mind comes from knowing that, should the unexpected occur, your final wishes are respected and your loved ones are shielded from undue financial strain. This is where insurance for funeral costs plays a vital role in offering much-needed reassurance. By securing adequate coverage, individuals can ensure their end-of-life expenses, including funeral arrangements and outstanding debts, are settled without placing a burden on their families.

For low-income families, accessing affordable funeral assistance can be a challenge. However, various options exist to help alleviate the financial burden. Many insurance providers offer policies tailored to meet different budgets, ensuring that everyone can plan for these significant expenses. With the right coverage in place, individuals can rest easy, knowing their loved ones will not have to navigate the complexities of funeral arrangements while grappling with overwhelming financial stress.

When planning for end-of-life expenses, choosing a reputable funeral provider and exploring options like funeral insurance can offer significant peace of mind. By understanding your financial obligations and taking proactive steps, such as considering long-term planning and funeral assistance programs for low-income families, you can ensure that your final arrangements are handled with dignity and your loved ones are supported during an emotional time. With the right preparation, you can navigate this sensitive topic, knowing that both you and your family will be protected.